Is There an Inheritance Tax in Florida? | Instrumental Wealth

Unlike most states in the U.S., Florida does not have either an income tax or an inheritance tax. However, if you are inheriting a sizable estate, you must consider federal tax implications. The federal estate tax applies if the entire estate’s value exceeds $12,920,000 (or $12.92m per spouse if married), but that threshold is subject to change when the TCJA expires in 2026.

Implications for Beneficiaries

For beneficiaries, this means a more straightforward process when inheriting assets from a Florida resident. Without the need to calculate or pay state inheritance tax, beneficiaries can focus on other potential tax implications, such as federal estate taxes.

It’s important to note that while Florida does not have a state inheritance tax, the absence of this tax does not exempt beneficiaries from any federal tax obligations. Beneficiaries should still be aware of federal tax laws and consult with a tax professional to ensure compliance.

Understanding the Federal Estate Tax

The federal government does not have an "inheritance tax" per se. Instead, it levies an "estate tax" on the entire value of a deceased person's estate before the assets are distributed to beneficiaries. This tax is based on the net value of the estate, which includes all assets owned at the time of death, minus any liabilities.

Current Thresholds and Rates

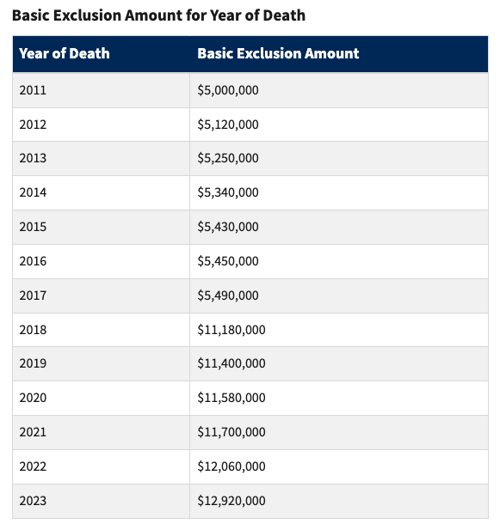

As of the last update, the federal estate tax applies to estates valued over $12,920,000 for individuals.* For married couples, this threshold doubles, allowing a combined exemption of up to $25,840,000. Estates valued below these amounts are not subject to federal estate tax.

*Chart and data from IRS.Gov, “What’s New – Estate and Gift Tax” for 2023

*Chart and data from IRS.Gov, “What’s New – Estate and Gift Tax” for 2023

For estates that exceed these exemption thresholds, the tax rate can range from 18% to 40%, depending on the estate's net value. The progressive rate structure means that larger estates will generally face higher tax rates.

Portability Between Spouses

One notable feature of the federal estate tax system is the concept of "portability." This allows a surviving spouse to utilize any unused portion of the deceased spouse's exemption.

For instance, if a spouse passes away and only uses $6,920,000 of their $12,920,000 exemption, the surviving spouse can add the unused $6,000,000 to their own exemption, increasing their total exemption to $18,920,000*.

*Note: This example is for illustrate purposes only.

Potential Changes on the Horizon

Beneficiaries should be aware that tax laws, including estate tax thresholds and rates, are subject to change. The current exemption amounts, set by the Tax Cuts and Jobs Act (TCJA), are scheduled to expire in 2026. Unless Congress takes action to extend or modify these provisions, the exemption amounts could revert to previous levels, adjusted for inflation.

Gift Tax and Lifetime Exemptions

In addition to the estate tax, the federal government also imposes a gift tax on substantial gifts made during one's lifetime. The gift tax and estate tax share a combined lifetime exemption. This means that large gifts given during one's life can reduce the available estate tax exemption upon death. It's essential for individuals to consider this interplay when planning their estates and making significant gifts.

Navigating Federal Tax Implications

While the absence of a state inheritance tax in Florida simplifies matters for beneficiaries, the federal estate tax can introduce complexities, especially for larger estates.

Beneficiaries and estate executors should consider consulting with tax professionals to understand potential tax liabilities, explore strategies to minimize taxes, and ensure compliance with all federal regulations.

Other Tax Concerns Despite No Florida Inheritance Tax

There are tax concerns for those who receive an inheritance in Florida in addition to the federal inheritance tax guidelines. Beneficiaries need to be mindful of the following situations:

Selling Inherited Assets

When it comes time to sell inherited assets, there are taxes to consider. While the person receiving the property does not pay taxes at the time of inheritance, they are responsible for taxes on any appreciation from the date the asset was received.

For example, let’s assume you inherit a property that is worth $20,000. A year later, you decide to sell it for $25,000. You are responsible for the appreciation of the assets you inherited. In this case, $5,000 of the sale is treated as taxable income.*

*Note: This example is for illustrate purposes only.

Inheriting From Non-US Citizens

Inheriting an estate from a non-US citizen can be tricky. The estate must go through probate in the country where the deceased lived. Once that process is complete, the estate will go through probate administration in the state of Florida.

Withdrawing Funds From Retirement Accounts

Withdrawing funds from inherited retirement accounts creates a taxable event. Just as the deceased person was responsible for taxes on their retirement accounts, the person inheriting those assets is also responsible once they are sold. One exception to this rule is assets held in a Roth IRA. Any funds in a Roth account are not subject to taxes.

Receiving Income From The Estate

Any income received from the estate before the property is transferred and treated as federal income. For example, if a tenant pays rent on an inherited asset before the estate is settled, the rent is treated as taxable income.

For more information on how to navigate Inheritance Taxes in Florida, schedule an appointment with one of our Instrumental Wealth specialists today.

Your Next Steps for Navigating Estate Taxes

If you have just received or are anticipating a large inheritance, it is important to take the right financial planning steps to use it to achieve your goals and minimize tax liabilities. While the right tax professionals can help you understand specifically how things will be taxed, consulting with an experienced wealth management advisor allows to take a step back for a more holistic view:

- How will this inheritance help me achieve my financial and/or retirement goals?

- How should this inheritance be allocated to minimize tax liabilities for the next 1, 3, 5, to 10 years?

- Would giving a portion of this inheritance to charity be to my advantage?

Take your next step and schedule a meeting here with our advisory team. We’ll listen to you and help you develop a plan for your inheritance.

Florida Inheritance Tax | Instrumental Wealth

Instrumental Wealth, LLC (“Instrumental Wealth”) is an SEC registered investment adviser located in Florida. Registration does not imply a certain level of skill or training. Instrumental Wealth may only transact business in those states in which it is notice filed or qualifies for an exemption from notice filing requirements. Information about Instrumental Wealth (inculcating its services, fees, and registration status) is available on the SEC’s IAPD website at www.adviserinfo.sec.gov. There is no guarantee that the views and opinions expressed in this presentation will come to pass. Advisory services are only offered to clients or prospective clients where Instrumental Wealth and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Instrumental Wealth unless a client service agreement is in place.